Argentina bond market plunder explained

Milei's dollar bonds are up 90% this year, and here's how the fraud works

Explaining the bond market fraud in Argentina

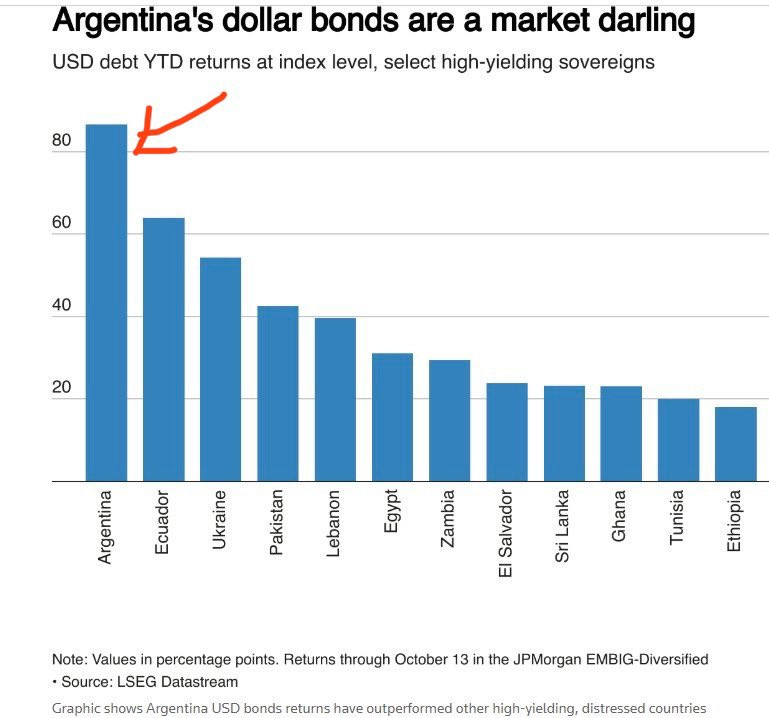

Milei's fans are celebrating how his Dollar bonds are up 90% this year. Here's how the international financiers' scam works in 9 steps:

1) Wall Street rating firms give awful scores for the bonds

2) This makes the yields go through the roof. Like 42%

3) Then, Western investors buy the bonds, knowing that "reforms" are coming.

4) Globalist puppet Milei slashes government spending and privatizes a whole lot of sectors. This is the neoliberal "shock therapy."

5) Western investors gobble up assets for pennies on the dollar

6) Then, Western rating firms reward this plunder by giving better ratings for the bonds.

7) Bond yields go down, to say 10%.

8) However, this means that bonds issued before are now worth much more, since they have higher yields. Bonds with 42% yield will be worth way more than those with 10% yield.

9) Thus investors from Step #3 above make a killing. Hence the amazing returns in Argentina’s dollar bonds this year.

10) US media and guys like Vivek and Elon Musk celebrate the great bond market in Argentina and give credit to libertarian and small government ideology.

Meanwhile, 54% of Argentinians are in poverty, consumer prices have tripled over the last year, the economy is in recession, and industrial production has been dwindling consistently.