Trump is back and so are the tariffs… bigger & better!

Trumps’ goals are sincere – to bring manufacturing back to America.

However, after decades of de-industrialization, trying to MAGA with tariffs and trade wars will fail (again).

Here's why:

There are three reasons why Trump cannot bring manufacturing back:

* Wall Street

* Lack of skills & infrastructure

* China's dominance

As the charts in above reveal, the US’ share of global manufacturing has declined, while China is now 2x as big as the US (in terms of value added).

As for the economic impact, manufacturing now only accounts for 10% of US GDP; and the number of Americans employed in manufacturing has declined a third since 1979, the peak year.

These are long-term trends that Trump could not reverse in his first term. And he won’t be able to do it this time either.

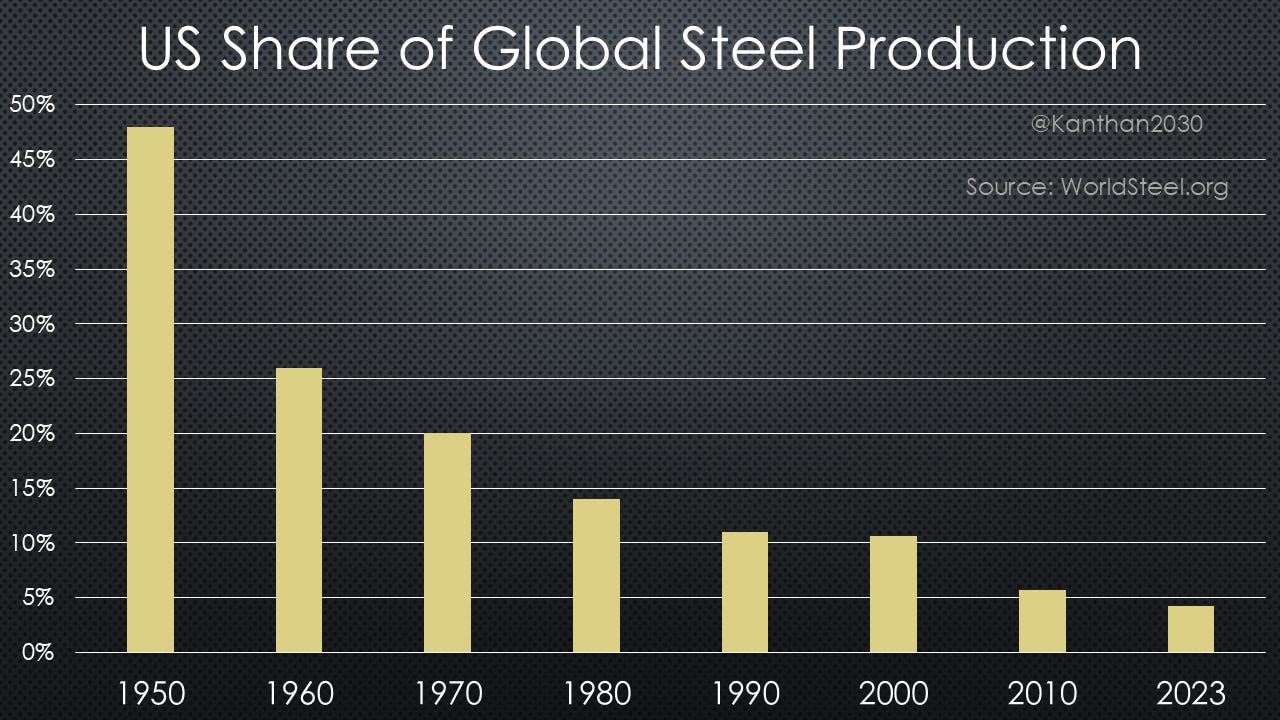

Take STEEL, Trump’s favorite.

Once upon a time, even Russian leaders openly admired the US steel industry.

But, due to competition from the USSR, Japan & Germany during the Cold War & China since then...

...US’ share of global steel production has fallen from 50% to 4%.

So, why did the US move away manufacturing, which is vital not only for good jobs but for national security?

One word: Neoliberalism.

This ideology based on maximizing profits for corporations and shareholders ruined American and Western economies. In the 1980s, it was sold as “Reagonomics” and “Thatcherism” in the US and UK.

Hollywood did its part with movies like Wall Street, which popularized the phrase, “Greed is good.”

Starting in 1980, the US swiftly became a country based on services and software, which are high-profit sectors. Manufacturing is labor- and capital-intensive, with very low profit margins.

This is why the capitalist leaders of America decided to outsource manufacturing to China and other developing nations.

Rather than investing in factories, workers and research, greedy financiers – who control the board of directors of all major corporations – spent TRILLIONS of dollars on stock buybacks and dividends. Such financial engineering is why the US stock market is worth $50 trillion. It’s all fugazi!

The result, of course, is tragic. Even the mighty US military industrial complex now cannot make missiles and fighter jets without components from Chinese suppliers. And China’s shipbuilding capacity is staggering 270 times larger than that of the US.

One of the key reasons that NATO failed in its proxy war against Putin is that Russia was able to manufacture more weapons and ammunition than the US and Europe combined!

China and Russia have hypersonic missiles, while the US is struggling to master that technology.

This is what happens when a nation is run by bean-counters and hedge fund managers.

What is that definition on insanity? Doing the same thing but expecting different results!

Let’s see what happened during Trump 1.0 when he imposed tariffs on steel and aluminum.

First, the steel production nudged up a little and then fell back to where it has been for the last 15 years – about 80 million tons a year.

As for the jobs in the steel industry? Went up by less than 5,000 and then declined when Trump left the office.

Aluminum has been actually worse. The US now produces 70% less aluminum than it did in 2012.

Another reason why the US cannot build back its manufacturing is the crumbling infrastructure, which would take trillions of dollars and a complete realignment of political and corporate priorities.

Look at the first video below – it shows an actual freight train on a twisted railway track in the US. This is like a fourth-world country. Transportation is pivotal to an industrial economy.

The second video is from China, which has 45,000 km of high-speed rail.

The infrastructure problems in the US are colossal. Roads, bridges, levees (dams), water systems, subways, electricity grid etc. are aging and failing. Whopping 45,000 bridges in America are structurally deficient.

After decades of offshoring, the US simply does not have skilled workers for manufacturing anymore.

Only 8% of the US workforce are in manufacturing, and only 5% are hardcore technical workers – the rest are in sectors like food, beverage and tobacco.

Listen to Tim Cook, CEO of Apple, explain why his iconic company prefers to have factories in China. Hint: It’s not about cheap labor.

If Trump and his advisers think that tariffs are going to slow down China, they should look at China’s trade surplus over the last eight years of trade war, tariffs and sanctions.

China’s trade surplus has more than doubled to a record amount of nearly $1 trillion.

Remember that Biden not only kept Trump’s tariffs, but imposed more draconian sanctions on China’s successful tech companies.

The world has moved on. There is a market outside the US. For China, its biggest trade partners are ASEAN countries and the Belt and Road Initiative (BRI) members.

The US accounts for only about 10% of China’s foreign trade. Thus, Trump’s favorite statement, “They need us more than we need them,” is not valid anymore.

Similarly, his attacks on allies and vassals such as Canada, EU and Australia are only going to isolate the US. Soon, all those targeted by Trump will establish cooperative trade agreements among themselves.

Has Trump heard of “Triffin’s Dilemma”?

His two fundamental notions about trade and dollar’s primacy are in direct conflict with one another!

That is, the US dollar CANNOT be the global reserve currency, if the US does NOT have trade deficits. In other words, if the US dollar must be the preferred currency for global trade and FOREX, then the US must run massive trade deficits with the rest of the world. How else are the other countries going to acquire US dollar?

Interestingly, Trump also acknowledged that the US will be a third-world country without the extraordinary privilege of the dollar.

There is no simple solution to the Triffin’s Dilemma. In a multipolar world, the US dollar will slowly lose its hegemony and the US empire will disintegrate.

De-dollarization is inevitable.

In 1988, The Economist predicted the demise (burning) of the US dollar by 2018 on its cover picture. Now, the 2025 magazine has Trump setting the dollar on fire!

So, what should Trump do? How can he revive US manufacturing?

First, he should embrace free trade and competition. Tariffs and protectionism are not going to make manufacturing great again.

Rather than punishing other countries, Trump should provide subsidies and tax cuts to US corporations based on their manufacturing output and the number of employees. These companies should also be prevented from squandering their profits on stock buybacks and dividends. In fact, stock buybacks should be banned altogether.

The US should focus on vocational colleges, where students learn real skills that can be used in manufacturing. No more fluff majors like history or gender studies.

The US should also be humble and realize that the tables have turned. It must invite Chinese companies to setup factories in the US in order for Americans to learn from the Chinese – just like China did American, European and Japanese companies three decades ago.

Believe it or not, once upon a time, the US excelled in manufacturing. So, good luck, America!

S.L. Kanthan